What we have seen on Wall Street in recent days, even during yesterday's lethargic second-half performance, is a significant amount of sector rotation. The recent growth concerns, prompted by worries about the Delta variant, have pushed investors back into the high-growth groups, many of which were big winners during the height of the coronavirus pandemic. The technology names, including the FANG stocks and the mega-cap companies, have been on fire. In fact, shares of Facebook hit an all-time high yesterday and Amazon.com stock has recovered sharply from the setback following its most recent quarterly report. The technology stocks, along with the more-defensive groups, have provided the leadership this week.

Conversely, the cyclical stocks are taking a breather, with the energy, financial, industrial, and materials names in the red during recent trading sessions. The mixed economic data of late, coupled with the infrastructure bill yet to reach President Biden's desk for signing, has taken a bite out of the value-oriented cyclical stocks. Moving forward, the defensive sectors may garner more attention, especially if concerns about a decelerating economy intensify. This morning, we received the latest initial weekly unemployment claims data, and that report showed a drop in claims to a pandemic-era low of 340,000. Elsewhere, the July U.S. trade gap figure narrowed from the biggest deficit in 29 years last month, while nonfarm productivity came in at a healthy 2.1%, but the figure fell a bit short of expectations.

Trading was light yesterday, with daily volume running well below its 20-day moving average, and we would not be surprised if that was the case once again today as investors await the labor market figures. The economic news has been the focus of Wall Street so far this week and that will likely be the case the next few days with reports due tomorrow on nonmanufacturing activity and employment and unemployment. That offset a better-than-expected reading on manufacturing activity, though there also were some employment concerns raised from the ISM manufacturing data. Treasury market yields fell on the ADP report, with investors moving some of their funds into safe-haven instruments, like bonds and the more-defensive equity groups. The yield on the 10-year Treasury note, which moves inversely to its price, fell below 1.30% this morning. Shares of Smith & Wesson Brands Inc. tumbled 11.5% in afternoon trading Thursday, after the gun maker reported a fiscal first-quarter profit that rose above expectations, but revenue came up short.

Analyst James Hardiman at Wedbush reiterated his neutral rating but cut his stock price target to $24 from $28. "Despite positive near-term earnings dynamics, investors have made it clear that they perceive [Smith & Wesson] to be a major pandemic beneficiary, which puts downward pressure on the stock over the course of 2021," Hardiman wrote in a note to clients. The stock has rallied 24.0% year to date, while the S&P 500 has advanced 20.6%.

Before The Bell – The U.S. stock market picked up where it left off in August, which was with the major equity averages at or near record highs. On point, the first trading session was a mostly positive one for traders, with NASDAQ Composite and the Russell 2000 pushing forward on the strength of the high-growth sectors. The Dow Jones Industrial Average, though, is on a modest three-day losing streak.

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Stocks, also known as equities, are shares of ownership that entitle the holder to a part of a company's assets and earnings. There are 60 major stock exchanges around the world and 16 of them each have a market capitalization of over $1 trillion. Both large players like banks or hedge funds and small investors participate in this market. The stock market operates on a system of supply and demand and has opportunities for long term investors and for day traders.

The stock market started positively yesterday, continuing the solid performance seen on Monday. Early trading was up even after Federal Reserve Chairman Powell signaled an accommodative interest-rate policy during his Jackson Hole, Wyoming symposium speech. But early positivity lasted only so long, as fears about slowing growth worldwide and higher inflation caused the tide to shift, and the market turned to the downside, with the major indices closing the session in the red. Looking ahead, the market looks like it will start strongly today, with the U.S. futures holding most of their gains following the ADP employment report. Oil futures settled higher Thursday, with U.S. prices marking their highest in about a month. The U.S. oil industry is "rushing to restore operations following Hurricane Ida," he said.

That was the highest front-month contract finish since Aug. 3, FactSet data show. Stock markets set new record highs on Tuesday as investors ended August in a buoyant mood, confident of an ongoing economic recovery and that the Federal Reserve's eventual paring back of its stimulus would not knock asset prices anytime soon. European stocks edged higher on Tuesday, on track for their seventh straight month of gains. The ADP employment report on Wednesday showed private payrolls rose by a subdued 374,000 in August. While up modestly from July, private-sector job growth has slowed from its pace earlier this year, confirming the impact the delta variant is having on the leisure, hospitality and service sectors.

This raises the potential for the official August nonfarm payroll report to underwhelm when it's released on Friday. We'd characterize this as a soft patch, not a sustained new direction for the labor market. But, along with the downturn in recent consumer-confidence readings, this does signal potential weakness in consumer spending for the third quarter.

Nevertheless, we think a gradually improving labor market will be the backbone of an ongoing economic expansion that should provide further support to the bull market. The US stock market contains well-known exchanges such as the NASDAQ Stock Market and the New York Stock Exchange. They have a reputation for trading strong, high-quality securities and feature some of the world's most actively traded companies such as Apple, Amazon, Bank of America, General Electric, ExxonMobil and Johnson & Johnson. One of our most popular chats is the Stocks chat where traders talk in real-time about where US stocks are going.

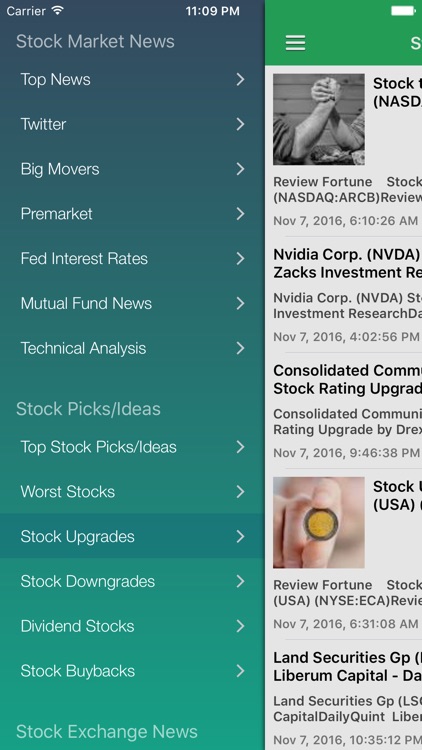

We offer access to free stock quotes, stock charts, breaking stock news, top market stories, free stock analyst ratings, SEC filings, stock price history, corporate events, public company financials and so much more. Stock Market (StockMarket.com) is a true disrupter, vastly improving the way people consume financial market data. The U.S. stock market closed out last week on a solid note, as Wall Street seemed pleased with the latest comments from the Federal Reserve. However, it remains to be seen if further market gains can be achieved during today's session. Overnight, the international markets have been making some progress, which is encouraging.

On our shores, the S&P futures are currently ahead roughly four points, suggesting a positive start to the day. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p.m. Market price returns do not represent the returns an investor would receive if shares were traded at other times. There are special risks associated with an investment in commodities, including market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes, and the impact of adverse political or financial factors. The Dow Jones Industrial Average is the most well-known share index in the USA. The Dow Jones was developed by Charles Henry Dow and originally contained just 12 American companies.

It was published for the first time in May 1896 and opened at a level of 40.94 points. Today, the Dow Jones Industrial Average consists of the 30 most important market-leading companies on the American stock exchange and reflects their growth. On Monday, the benchmark equity indices on the BSE and NSE had surged over 1 per cent to end at fresh record highs amid positive cues in the global market. Texas Capital will invest significantly in Treasury Solutions so it can expand products and services, including launching a broker-dealer, allowing it to generate fee-based revenue and earnings. A string of international data showed the global economic recovery is proceeding, but in an uneven fashion. China's Caixin manufacturing PMI softened to its weakest level in a year and a half, while eurozone manufacturing activity remained healthy.

Also on the positive side were Australian GDP and South Korean export readings, though German retail sales weakened. All told, these data confirm the global economy is advancing, but is far from firing on all cylinders. We think the international expansion will gain some steam in 2022, but recent COVID-19 developments have certainly pushed back the timeline. We continue to think allocations to international equities are appropriate within diversified portfolios given the broader outlook for growth. Bloomberg | Quint is a multiplatform, Indian business and financial news company. London prides itself on being a destination for international companies and investors to come together to power the world's economy.

Our products and services are designed to support companies with global ambitions. U.S. stock indexes rose to record highs Thursday as weekly jobless claims dipped to a pandemic-era low ahead of the August jobs report. Record-setting world stocks moved higher on Thursday after jobless claims data suggested the U.S. labor market was charging ahead even as new COVID-19 infections surge, while the risk of a sub-par U.S. payrolls report kept the dollar on the defensive. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates.

When interest rates go up, bond prices typically drop, and vice versa. Get the latest stock market news and analysis from the floor of the New York Stock Exchange. Verizon Communications Inc. undefined said Thursday that it will raise its quarterly dividend by 2.0%, to 64.00 cents a share from 62.75 cents a share. Shareholders of record on Oct. 8 will be paid the new dividend rate on Nov. 1. The telecommunications company's stock rose 0.1% in afternoon trading. Based on current stock prices, the new annual dividend rate implies a dividend yield of 4.66%, which compares with the implied yield for the S&P 500 undefined of 1.33%.

It also keeps Verizon's stock as the third highest yielding within the Dow Jones Industrial Average undefined, below Chevron Corp. undefined at 5.45% and International Business Machines Corp. undefined at 4.71%, and just ahead of Dow Inc. undefined at 4.45%. Bookmark this page to make sure you stay on top of all the latest action in the stock market, and be sure to check The Big Picture after each market close for more detailed analysis and stocks to watch. Asia stock markets opened lower on Tuesday despite fresh all-time highs on Wall Street, as worries about China's slowing economic growth and regulatory changes weighed on investor sentiment. The benchmark equity indices on the BSE and National Stock Exchange surged over 1 per cent to settle at their fresh record highs on Tuesday led by gains in metals, information technology and pharmaceutical stocks. The Indian stock market scaled new highs on Tuesday with the BSE Sensex hitting the 57,000 mark for the first time in its history while Nifty50 also touched the 17,000 mark for the first time ever on Tuesday.

The market touched an all-time high taking mixed global cues and factoring in the GDP growth of the country that indicates strong bounce bank of Covid-19 hit Indian economy. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. And it's whipsawed a bit this week, first jumping on news that Apple's iPhone was likely to include satellite connectivity, then giving back much of the gain following a report that the iPhone satellite features would focus only on emergency usage. Among analysts, Morgan Stanley's Keith Weiss left his equal weight rating on Autodesk's shares unchanged, but trimmed his stock price target to $324 a share from $334 a share. Weiss cited the free cash flow matter for his haircut on the company's stock price.

After closing the books on a seventh consecutive monthly gain in August, equities started September on a flat note, with the major indexes little changed on Wednesday. Underlying performance leaned cautious, as defensive sectors and growth investments outperformed while cyclicals lagged. Oil prices were also relatively flat, as today's OPEC+ meeting saw the group raise its demand outlook but also agree to gradual increases in production.

Keeping with the day's trend, the bond market was also quiet, with 10-year benchmark Treasury yields hovering around the 1.30% mark. New Highs/Lows only includes stocks traded on NYSE, NYSE Arca, Nasdaq or OTC-US exchanges with over 5 days of prices, with a last price above $0.25 and below $10,000, and with volume greater than 1000 shares. Price Volume Leaders provide an insight to the most significant stocks based on the value of the shares traded, as opposed to Volume Leaders which only takes into account the number of shares traded. For example, 1 million shares traded at $2 has a value of $2M where 100,000 shares traded at $100 has a value of $10M . U.S stock indexes this morning are moving higher, with the S&P 500 posting a new all-time high.

Strength in technology stocks and energy companies today is supportive for the overall market. Stocks also garnered support today on signs of strength in the U.S. labor market after weekly initial unemployment claims fell more than expected to a 17-month low. Our website offers information about investing and saving, but not personal advice. If you're not sure which investments are right for you, please request advice, for example from our financial advisers. If you decide to invest, read our important investment notes first and remember that investments can go up and down in value, so you could get back less than you put in. For more than 150 years, investors have looked to London's investment funds market as a rich source of innovative and non-correlated income opportunities.

Since 2018, one such source has been music royalties when Hipgnosis became the first music royalty fund to list on London Stock Exchange. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. This and other information may be found in each fund's prospectus or summary prospectus, if available. Always read the prospectus or summary prospectus carefully before you invest or send money. The major U.S. stock averages turned in a mixed performance on Monday, however some of the indexes reached new highs.

As we look to the new day, U.S. stock futures are suggesting the major market averages will open down slightly. Foreign institutional investors turned net buyers in the capital market as they purchased shares worth Rs 1,202.81 crore on Monday, as per provisional exchange data. Edelweiss Broking Ltd. acts in the capacity of distributor for Products such as OFS, Mutual Funds, IPOs and NCD etc. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Investment in securities market are subject to market risks, read all the scheme related documents carefully before investing.

On September 1, Sensex closed 214 points lower at 57,338 and Nifty fell 56 points to 17,076, snapping a seven session rally. Nifty and Sensex touched their all-time highs of 17,225.75 and 57,918.71 intra day, in the opening trade on the back of better GDP data announced a day ago. Stock index futures are indicating a higher open with rates edging down as investors await another set of numbers on the labor market ahead of the payrolls report Friday.

Real time data on the E mini Dow Jones Industrial average Index Futures . The Dow Jones futures index is a price-weighted average of blue-chip stocks that are generally the leaders in their industry. More information can be found in other sections, such as Dow Jones futures live charts, historical data and technical analysis. Albertson's Companies (ACI +7.0%) and BJ's Wholesale (BJ +3.5%) also reached stock price highs on the news, while Sprouts Farmers Market (SFM +2.8%) and Bunge Limited (BG +2.6%) are trading up. In 2H21, the company expects to achieve a mid-single-digit same-store sales increase, primarily driven by better inventory positions in key categories and continued growth in average ticket. In addition, the Company anticipates year-over-year earnings growth despite absorbing significant incremental freight costs.

ChargePoint's Q2 revenue surged past expectations, rising nearly 61% from last year. The company also raised its full-year forecast and provided a Q3 target above the current consensus of market analysts. Amazon Web Services holds the largest cloud platform market share, edging out second-place Microsoft Azure. When Amazon reported second-quarter earnings in July, AWS revenue was up 37% year-over-year, representing $14.8 billion of the total $113.1 billion in sales.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal. For your selected market (U.S. or Canada), the widget provides a visual snapshot of the major stock market sectors, ranked from highest to lowest percent change. London Stock Exchange is a doorway to growth, enabling companies to raise capital and investors to build their portfolios across a range of global markets. The New York Stock Exchange is where icons and disruptors come to build on their success and shape the future. We've created the world's largest and most trusted equities exchange, the leading ETF exchange and the world's most deterministic trading technology.

Our data, technology and expertise help today's leaders and tomorrow's visionaries capitalize on opportunity in the public markets. You'll find the latest prices and price changes for the Nasdaq, S&P 500 and the Dow Jones Industrial Average, as well as for the Russell 2000. You'll also get the latest performance of the IBD 50 index, which features today's top growth stocks.

Spot gold climbed 0.5% to $1,818.46 per ounce by 0636 GMT, edging closer to the 3-1/2-week high hit on Monday. On the Multi Commodity Exchange, crude oil for September delivery dropped by Rs 61, or 1.2 per cent, to Rs 5,010 per barrel with a business volume of 4,204 lots. Around 10.00 a.m., Sensex was trading at 56,937.21, higher by 47.45 points or 0.08 per cent from its previous close of 56,889.76 points. Indian rupee opened marginally lower at 73.04 per dollar on Wednesday against previous close of 73 amid buying seen in the domestic equity market. "Benchmark Indices are expected to open on a flat note as suggested by trends on SGX Nifty.

US markets ended marginally lower on Tuesday with Dow Jones, S&P 500 and NASDAQ falling ~-0.1 per cent yesterday. Asian markets were steady in the early Wednesday trade with Nikkei trading ~+1.27 per cent while Chinese and Hong Kong markets are trading flat. India's Q1FY22 GDP grew 20.1 per cent, GVA growth at 18.8 per cent in Q1FY22 while the street estimates for GDP and GVA are 21 per cent and 19.6 per cent respectively.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.