First and foremost, if you can pay your loan, please continue to do so. But if you are facing financial difficulties, we may be able to provide relief. The assistance programs we offer, including those for federally-backed loans associated with the federal CARES Act, are payment forbearance. Forbearance is not forgiveness, but rather a temporary pause of your monthly mortgage payment. Please be aware that when the forbearance period is over, we consider several options, which may include a lump sum payment, a repayment plan over a set period of time, or a loan modification. For borrowers that request post-forebearance assistance and qualify, lump sum payment may not be required.

In the case of COVID-19 relief under the CARES Act, borrowers with financial hardships due to the COVID-19 emergency are entitled to a forbearance period where they don't make their mortgage payments at all. However, those payments must be paid, and the loan brought current, at the end of the forbearance period. If you are unable to bring your loan current all at once, which is not uncommon, you are encouraged to apply for further assistance. If you qualify for further assistance and are approved, alternative options, such as short term repayment plans or permanent loan modifications may be available. The Federal Housing Administration announced that starting on July 1, 2020, Fannie Mae and Freddie Mac are now offering a new repayment solution for homeowners who are in forbearance due to the COVID-19 pandemic. The payment deferral option allows borrowers the ability to repay their missed payments at the time the home is sold, refinanced, or at the end of the loan.

Homeowners with federal loans are not required to pay back missed payments in one lump sum. To be clear, homeowners cannot simply stop making mortgage payments - you'll need to contact your lender to work out a payment plan. Your loan servicer will determine whether you qualify for assistance and how you'll repay missed payments. Importantly, this plan will not forgive debt or provide you with condition-free cash, but will instead allow you to find an agreement that lets you work things out when you recover financially. This might include extending the term of your loan or just paying the loan's interest for an agreed-upon duration. The Flex Modification also makes your loan current, with your lender and on your credit report — in other words, you're no longer missing any payments.

At the end of your forbearance, if you are unable to resume monthly USDA loan payments, you may be eligible for the USDA COVID-19 Special Relief Measure. This loan modification aims to reduce your monthly mortgage payment by up to 20%. Your servicer will work with you to reduce your interest rate; if that doesn't provide enough relief, you may be able to have the term extended as well.

Borrowers may also be considered for a mortgage recovery advance, which provides funds to help cover past due payments and other costs. We encourage borrowers start with a 3-month (90-day) forbearance period, and not go longer until they know they need it. We strongly recommend against suspending your payments beyond 90 days unless you really need it. On March 11, 2021, President Joe Biden signed the American Rescue Plan Act of 2021 into law.

The law creates a Homeowners Assistance Fund to provide $10 billion to the states to help struggling homeowners catch up on mortgage payments, utility costs, and other housing-related expenses. The Homeowner Assistance Fund expands the Hardest Hit Fund model by providing federal aid to all states to help homeowners stay in their homes. To find out about homeowner-relief programs in your area, contact your state's housing finance agency. If your VA forbearance is ending and you aren't able to go back to making your monthly mortgage payments, you may be able to get a COVID-19 Refund Modification. This can include your mortgage servicer changing the terms of your VA loan to reduce your monthly payments by 20% or more.

If you are facing extreme hardship, the VA may purchase some of your missed payments and principal in order to reduce the overall amount that you owe. Regardless of mortgage type, contact your lender to discuss relief options. The federal government has encouraged all lenders to support homeowners who need mortgage assistance due to hardship brought about by the coronavirus pandemic. If you need a more permanent solution, say after a forbearance period ends, you may apply for a loan modification or another option.

Fannie Mae and Freddie Mac offer eligible homeowners modifications, often after a forbearance. Homeowners with FHA-insured loans have access to FHA's suite of loss mitigation options. If you have another type of loan, most banks and mortgage lenders offer in-house ("proprietary") modifications. Even if your loan isn't federally backed, your servicer might offer you a forbearance or another form of relief, like a waiver of late fees or a loan modification. Also, your state might provide special protections or programs for mortgage borrowers. Fannie Mae's Disaster Response Network™ is another resource you can utilize.

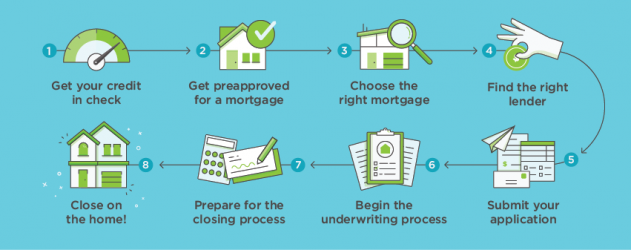

If you think you might have trouble making a mortgage payment your first call should be to your mortgage servicer . They may be able to arrange temporary mortgage assistance options, including a mortgage forbearance plan. If you received a COVID-19 forbearance from the VA and missed at least one payment on your VA loan, you may be eligible for a VA Partial Claim Payment when you are ready to resume paying your mortgage.

The VAPCP has strict requirements, including that either your loan began after March 1, 2020, or that you were no more than 30 days delinquent on March 1, 2020. The VAPCP is a second mortgage that can cover any missed payments, with a limit of 30% of your current outstanding principal . You can repay it at any time without penalty, but it must be repaid when you sell, refinance or finish paying your VA loan. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads.

We encourage users to contact their lawyers, credit counselors, lenders, and housing counselors. These actions were taken by three federal agencies that back mortgages – the Department of Housing and Urban Development , Department of Veterans Affairs , and Department of Agriculture . The Federal Housing Finance Agency provided similar relief for mortgages backed by Fannie Mae and Freddie Mac. The COVID-19 Mortgage Relief program helps Oregon homeowners who are struggling to make their mortgage payments.

For eligible applicants currently receiving unemployment benefits, it will bring their mortgage current and make up to six monthly payments directly to your mortgage servicer. For those who have returned to work, but are behind on their mortgage, it will bring your account current. It's important to have some cushion in your budget for unexpected or emergency costs. You also can adjust your loan and down payment amounts, interest rate and loan term to see how those variables affect your monthly payment. Your specific interest rate will depend on your overall credit profile and debt-to-income ratio, or DTI, which is the sum of all of your debts and new mortgage payment divided by your gross monthly income. A lower credit score and higher DTI can make you a riskier borrower in lenders' eyes.

Generally, the riskier you seem on paper, the higher your interest rate will be. Our monthly payment estimates are broken down by principal, interest, property taxes and homeowners insurance. We take our calculator a step further by factoring in your credit score range, ZIP code and HOA fees to give you a more precise payment estimate. You'll also go into the homebuying process with a more accurate picture of how to calculate mortgage payments and purchase with confidence.

After you run some estimates, read on for more education and homebuying tips. The grant can provide assistance on arrearages , security deposits for new rentals, and currently due monthly payments over the course of 100 days covering up 6 months of rent or mortgage payments. This grant is not to exceed the monthly mortgage or rent payment due, except in the case of documented eligible arrearages, and is capped at $12,000 per household. The DSHA's Preferred Plus Program offers a second mortgage loan of up to 5% of your home's purchase price.

You can put the money toward your down payment or closing costs. You'd need to repay the money when you sell the home, refinance, or stop using it as your primary residence. Fannie Mae is offering repayment options for homeowners who missed their mortgage payments due to a financial hardship related to COVID-19. In fact, earlier this year, Fannie Mae announced a new COVID-19 payment deferral option. As a homeowner with a federally backed mortgage loan, you will need to contact your loan servicer to request forbearance.

You do not need to submit extensive documentation, mainly only affirmation of your financial hardship, which can be done over the phone. Depending on when your initial forbearance began, you can extend forbearance an additional 180 or even 360 days. With this option, you and your mortgage company agree to temporarily suspend or reduce your monthly mortgage payments for a specific period of time. This option lets you deal with your short-term financial problems by giving you time to get back on your feet and bring your mortgage current.

If you can afford to make your mortgage payments, please do so. The longer you put off making payments now, the more difficult it may be to bring your payments current later. The time-period for which you are eligible for payment relief is limited, so you should not ask for assistance before you really need it. If your down payment was less than a 20% of your home's purchase price, you had to get mortgage insurance. This insurance protects the financial institution in case you can't make your payments.

They have programs in place to help you if you are having difficulty making your mortgage payments. Looking for the Virginia Housing loan that's right for you? Virginia Housing offers a variety of affordable home mortgages. Some don't require any downpayment; some allow for lower credit scores; and some offer an MCC to help reduce federal taxes.

Virginia Housing makes homeownership affordable through our "Virginia Housing Loan Combo," a down payment grant, plus an MCC , plus our free homebuyers class. All loans have maximum income and sales price limits and/or loan limits, which vary according to where the home is located. If you are experiencing financial hardship due to COVID-19, the federal government is offering relief options to homeowners through the recently passed CARES Act. In addition, for those borrowers who do not qualify, many banks and credit unions in Connecticut are offering relief consumers may qualify for. Please read the information below provided carefully, in order to determine which option meets your needs.

If you have a private lender and servicer, then your forbearance agreement will decide what happens. Some private lenders might make you pay all missed payments immediately. However, the Consumer Financial Protection Bureau requires mortgage servicers to work with most borrowers to try to avoid foreclosure, so you may be able to modify your contract. Contact your servicer to discuss what options may be open to you. The forbearance period will generally last up to 180 days and can possibly be extended, generally for another 180 days.

If you've recently fallen behind on mortgage payments, or think you soon will, due to the coronavirus (COVID-19) outbreak, relief might be available. You can ask for a forbearance, which provides temporary payment relief, or apply for a more permanent loss mitigation option, like a loan modification. If you were already behind on payments when you asked for forbearance, that delinquency may show up on your credit report until you are current with payments.

This is one reason it's better to request mortgage assistance before you have missed a payment. Once you reach the end of your forbearance period, you may qualify for additional assistance if you need it. Work with your servicer and, if possible, resume making your regular payments. If you still need assistance, ask your servicer what other options are available. This could include reducing your monthly payments or some other type ofloan modification. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

After the forbearance has ended, you will need to repay the amount that was reduced or suspended. However, you are not required to repay the missed amount all at once, though you have that option. Under the federal CARES Act, you are eligible for assistance if you have a federally-backed mortgage loan and are experiencing a financial hardship due, directly or indirectly, to the COVID-19 emergency.

For example, you may be subject to a COVID-19 financial hardship if you or your spouse have lost employment due to the crisis. You will be required to affirm that you are experiencing such a hardship. You will not be required to provide additional documentation. However, many homeowners will need deeper assistance due to pandemic-related income loss.

For example, due to the economic crisis caused by the pandemic, some homeowners are earning less than they were before the pandemic. This brings options for homeowners with mortgages backed by HUD, USDA, and VA closer in alignment with options for homeowners with mortgages backed by Fannie Mae and Freddie Mac. If you have an endowment mortgage, you could think about giving up your endowment policy or selling it off to an investor. This will provide you with a lump sum of money which you can use to help pay off the debt.

However, you should think very carefully before doing this. You will need to find another way to pay off your mortgage loan and you will also need to find alternative life insurance cover. You will also need to find out whether there would be any penalties or other costs involved in bringing your endowment policy to an end. Your financial institution may offer special payment arrangements unique to your situation. With this option, you and your financial institution agree to recover late payments over the shortest period, within your capacity. Special payment arrangements can include reducing your mortgage payments for an agreed-upon time.

When you defer your mortgage payments, your financial institution continues to charge interest on the amount you owe. Your financial institution adds the missed interest payments to your mortgage principal. They add this amount at the end of the deferral period, or each time a mortgage payment is due.

First-time home buyers have access to many grants, loans and financial help that can make buying a home easier. First-time buying assistance can include help with down payments and closing costs, tax credits or education. You might be able to get help from your local, state or federal government if you meet income standards. This applies only to accounts for which the consumer has fulfilled requirements pursuant to the forbearance or modified payment agreement. This credit protection is available from January 31, 2020 and ends at the later of 120 days after enactment of the bill or 120 days after the national emergency declaration related to the coronavirus is terminated.

Mortgage Forbearance.Servicers required to provide 180 days of mortgage forbearance to borrowers attesting to COVID-19 financial hardship. Servicer may not charge any fees, interest, or penalties beyond amounts scheduled or calculated as if borrower made payments on time and in full. Be prepared to wait, and also check your companies website for online options.

On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.